Assortment Analytics

Optimizing assortments to drive sales

Valued suppliers help refine assortments at the geographic and demographic level.

For new vendors, Product Line Reviews are one of the main ways onto the shelves of a retailer. However, for an incumbent retailer, a Product Line Review is something to be avoided. There is always the risk of losing business. The best vendors run their own process to determine their winners and losers, and they constantly look to upgrade their assortment. Geography and Demographics play a role here too. A winner in one market or demographic may be a loser in another. The ability to deeply analyze sales data at a store level and associate it with geographical and demographical data is becoming a key that differentiates good suppliers and great ones.

At Total Retail Group, we have extensive experience in conducting assortment analysis. We have data feeds by retailer and store that allow for advanced analysis to understand where and why certain products are selling and others are not. With these insights, our clients can continuously self-evaluate their category, optimize sales, and stay in front of the next Product Line Review.

Case Study

A large player in the appliance market came to us with an opportunity. They were the sole supplier to a major retailer in their category. They believed that there was an opportunity to upgrade the assortment in certain stores based on changes in the market, especially in upscale neighborhoods. They had executed a few off-shelf promos of these higher ticket items with success, but these promos were not in all stores, at various times of the year, and offered at discounted retails. There was also the question of how much was driven by the off-shelf nature of the offer and how that would translate to on-shelf.

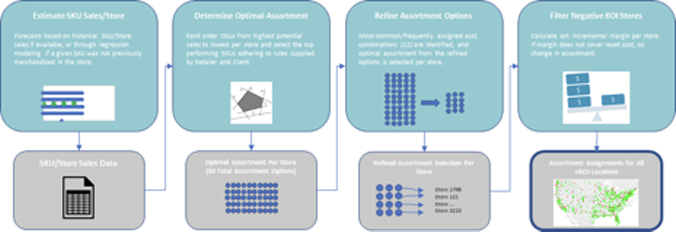

TRG designed an Assortment Analytics study that normalized the sales for on-shelf vs off-shelf and adjusted for future promo vs everyday pricing. We used regression analysis to project sales in stores that had not executed the promo. We then estimated the sales of all the current and potential items for every store in the chain. Each store’s items were racked and stacked and then adjusted to accommodate assortment rules established by the retailer and vendor (e.g., certain items had to be in every store, certain finishes had to be represented at least one time). The result was the optimal assortment for every store and projected sales that included a 20+% growth opportunity.

But there was a problem. The optimized assortment lead to over 50 unique assortments; more than the retail buyer was willing to execute and manage. So, the Total Retail Group analytics team created a process to merge like assortments all while minimizing the impact on potential sales.

In the end, we identified 12 unique assortments across entire chain and still preserved 90% of the potential sales lift. The new assortment was executed nationally and resulted in 20+% comp sales growth in the category for our client and the retailer.